3 Key Cap Table Management Concepts

In the early days of building a startup, the cap table shouldn’t take much of a founder’s attention. It needs to be accurate when it matters, but there are few moments when it matters early on. Because of an early-stage startup’s relatively simple ownership structure, many founders choose to manage the cap table on their own instead of paying for a SaaS subscription—or a lawyer—to maintain it.

Still, it only takes one cap table issue to disrupt the entire company. So I want to talk about three lessons that I wished I’d known when I launched my first startup, all of which still affect many founders today.

Prose vs. formulas

The cap table is a representation of company ownership, most often kept in a spreadsheet as a mathematical interpretation of legal prose from equity and debt contracts. Therein lies the root of the problem with cap tables. As your company increases in complexity over time, so does the probability of the cap table falling out of sync with its legal reality.

The simplest example where things go wrong is the vesting schedule. We’ll use the most common vesting schedule, which is a 4-year schedule with a 25% cliff after the first year followed by monthly vesting milestones after the first year.

Here’s how this appears in prose with a repurchase right on founder stock:

On the date one (1) year from [VESTING_COMMENCEMENT_DATE] (the “Vesting Commencement Date”) twenty-five percent (25%) of the Shares subject to the Repurchase Option shall vest and be released from the Repurchase Option. Thereafter, 1/48th of the Shares shall vest and be released from the Repurchase Option on each monthly anniversary of the Vesting Commencement Date so that One Hundred Percent (100%) of the Shares shall be released from the Repurchase Option on the fourth (4th) anniversary of the Vesting Commencement Date, in any event, subject to the Founder’s continued service to the Company through each such date.

And here’s how that same schedule looks in a spreadsheet formula bar: =ROUNDDOWN(IF(([CLIFF_DATE]-[VESTING_COMMENCEMENT_DATE])>=365,([SHARES_GRANTED]*0.25)+((1/48)*[SHARES_GRANTED]*(IF(DAY(NOW())>=DAY([CLIFF_DATE]),0,-1)+(YEAR(NOW())-YEAR([CLIFF_DATE])) *12+MONTH(NOW())-MONTH([CLIFF_DATE]))),0),0)

The formula looks complicated because of date math. Many elements of the cap table, like vesting or interest accumulation, are functions of time. But a larger problem is the interpretation of the legal prose. How does the company handle fractional shares in the math? Does your company recognize a 365-day or 360-day calendar year? Is the vesting commencement date different from the grant date listed in the stock grant notice? Are 100% of shares subject to the repurchase right?

You’ll need these answers to fully understand your contracts, model future fundraising or exit scenarios, or simply to have conversations with employees or investors. Any uncertainty means you’ll have to turn to your lawyer, and that gets very expensive over time.

The cap table isn’t really a table after all

Unless a startup is using a SaaS platform to manage their cap table, it’s unlikely they’ll go so far to have vesting calculations in the cap table spreadsheet. Instead, they’ll show the total shares or options and if a recipient leaves they’ll adjust the cap table accordingly. The result is a cap table that is only accurate at specific points in time.

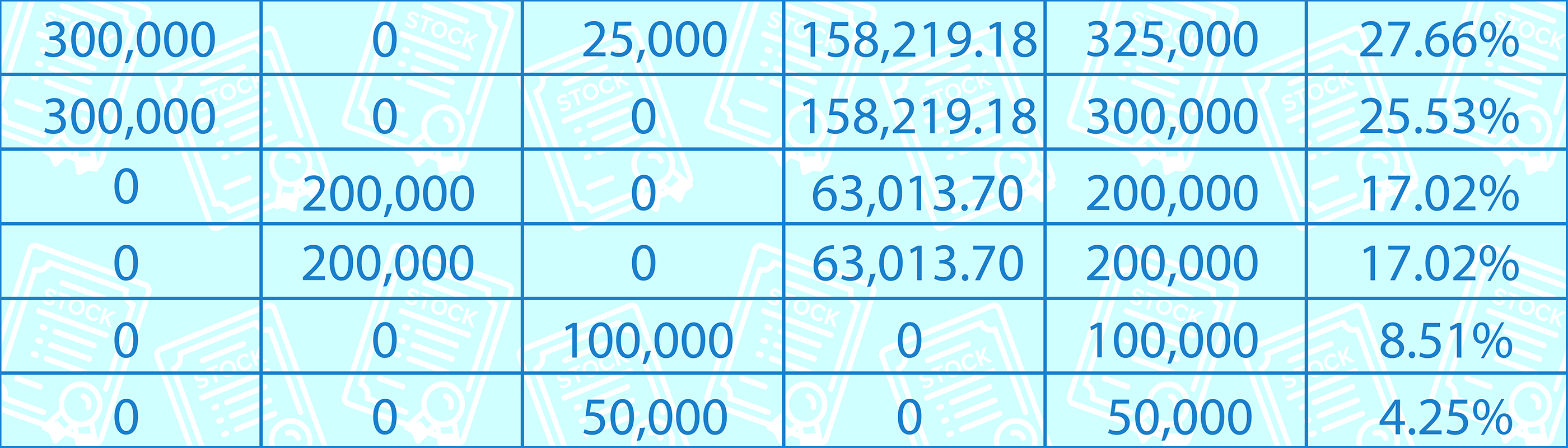

To continue the vesting example from above, if a founders’ shares were partially repurchased then the number listed in the table does not tell the whole story. There was a grant event, a repurchase event that likely reduced the total outstanding shares in the company, and finally a sum of shares no longer subject to repurchase.

The cap table is really a living ledger. It’s a history of every transaction that resulted in your ownership structure as it stands today, but also contains the blueprint of what it will look like tomorrow.

Percentages are an output, not an input

It’s difficult to avoid thinking in percentages with your company. It’s how you discuss splitting equity with your co-founders when establishing your startup, and it’s how you speak with investors: “I’m asking for $2 million dollars, in exchange for a 20% equity stake in my company.”

But when it comes to cap table math, speaking or modeling ownership in percentages will get you in trouble.

If you’re hiring an engineer and explaining the stock options component of their offer, what you’re offering them is a specific number of options. The obvious question is “what percent of the company are these options worth?” What’s not obvious is that the answer may only be true at the time it’s answered, and this engineer will continue to get diluted over time—having a smaller piece of a (hopefully) larger pie.

Worse than speaking loosely about percentages is modeling future scenarios based on percentages. Imagine you’re fundraising, and a current investor who owns 5% of the company wants to know what the cap table looks like when the new money comes in. Doing the math based on their 5% alone will give you a different result than doing the math based on their total shares. Why? First, the contracts are written with respect to shares, not percentages, so you’re straying further from the legal reality. Second, their shares may have preferences that come into play for some or all of their shares, other outstanding warrants or convertibles may be triggered that further change the outstanding share volume, or other contracts may exist that also contribute to the overall mechanics of this round.

Other ways to mitigate risk

Founders have choices when it comes to addressing and mitigating the confusion and risk of ownership tracking. Some startups go the route of standardized documents to reduce cost and minimize complexity in the prose. Some choose a SaaS platform to help with the math and assist in converting the prose to a model. Some can afford to pay their lawyers to maintain the cap table and never look back.

We’ve built all three into Gust Launch for startups that have yet to establish their legal entity, so they can start clean from day one with an always-accurate cap table. The future of ledger technology and legal technology is rapidly changing, and we’re excited to be a part of it.

Gust Launch makes managing equity effortless.

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.