What Your Cap Table Tells Investors About You and Your Company

This post originally appeared on Startup Stack’s blog.

If you have raised capital from investors before, you probably noticed that one of the first requests from potential investors is for you to send them your current cap table.

Why would an investor be so interested in seeing your cap table? What might they be looking for? What might you be telling investors about you and your company through your cap table?

Here is a list of seven things investors will look for when reviewing your cap table:

1. How much equity do the founders and key employees have?

And what are their vesting schedules? Investors want to make sure the founders and key employees have enough equity in the company to incentivize them to stay and keep pushing forward. Depending on how many more rounds of funding might be required, they will be interested in whether this will be adequate considering the future dilution that will come with each funding round. Investors will also be interested in where the founders and key employees are at in terms of the vesting of their equity. A founder or employee who is already fully-vested may not have the incentive to stick around. Astute investors will want to make sure key team members are incentivized properly to stay and look to make sure you haven’t already given away too much of the company.

2. Who are the key employees that have left the company and why?

If an investor sees employees or founders on the cap table that are no longer at the company, they may ask themselves why. Did the employee recognize something fundamentally wrong in the company? What was their role and what did they know that the investor might not know? Are there grievances or potential lawsuits? There is a lot to learn not only from who is on your cap table, but also who is no longer on your cap table.

3. How much equity did you set aside for your option pool?

Is the amount of equity carved out for stock options sufficient to meet the hiring needs for the company? In addition to the cap table, most investors will independently ask for a hiring plan for the next 12 – 18 months. They will compare this to what is set aside in the option pool. If they feel it is insufficient, they will request that you increase the option pool to match your hiring needs. This also gives investors a good idea of how good you are at planning and managing your equity. If your option pool and hiring plans are in sync, this is a positive sign of well thought out business planning. If not, it could be a potential red flag, or at least an area they know needs more attention.

4. What is your employee turnover?

Yes, investors may be able to get a glimpse into the company’s culture by just looking at its historical cap table. Again, the people who are no longer on the cap table, can be as important as those who still are. Are there a lot of employees who received option grants who have since left the company? What about the executive team, is it still intact or is it more like a revolving door? High employee turnover (especially in the executive ranks) may pose concerns or at least lead to questions. In contrast, low employee turnover and a cohesive executive management team that is aligned might increase investor confidence.

5. Who are the other investors in your cap table?

And how much equity do they own? Your new investors will want to know who the other investors are. They could look for quality and quantity. Are there hundreds of small investors on the cap table that all think they have a say, or a handful of strategic investors who continue to add value and want to participate in the current round? Are there any unreputable investors that new investors might not want to be associated with? Yes, it does matter who is on your cap table and investors will want to know.

6. What were the previous terms of financing?

Did you agree to any preferences or other obligations that might cause concern for your new investors? It is always good to keep in mind that preferences and negotiated terms in early funding rounds may set a precedent for future rounds. This isn’t always in the best interest of the company, or even the early investors. And this is something that will get reviewed and may scare off future investors. A good rule of thumb is to keep early financing rounds standard and simple if you plan on raising additional capital.

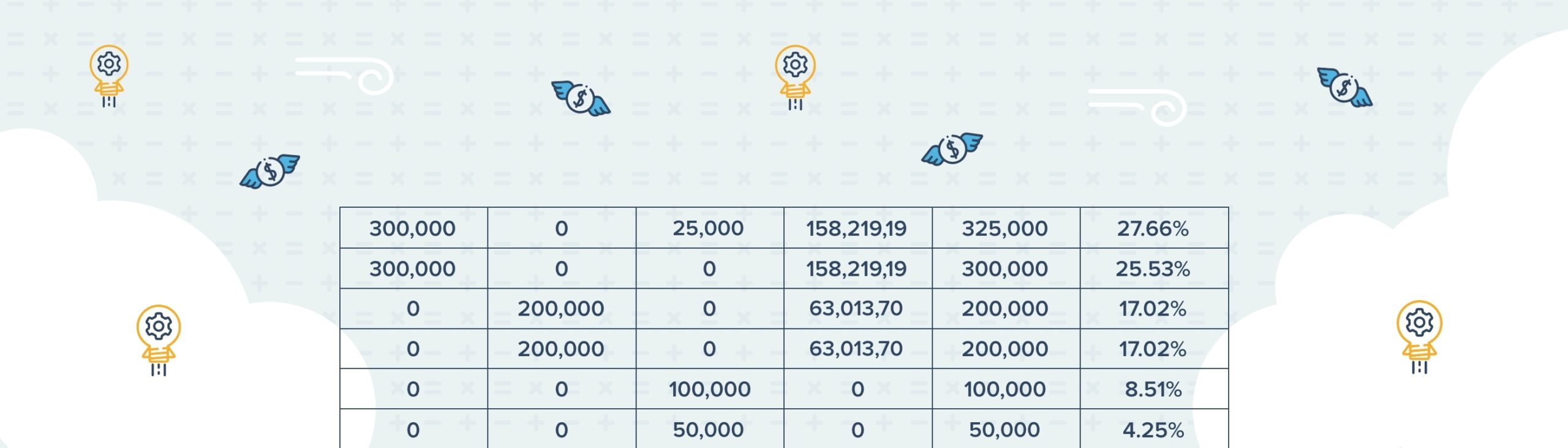

7. Do you have errors on your cap table?

When reviewing your cap table, investors will look to make sure there are not any errors. After all, they need to know that the current capitalization structure is accurate in order to know what it will look like after they make their investment. And if there are errors in your cap table, this might not only signal a lack of competence or attention to detail, but also cause some concern in regards to how the equity will be tracked for your new investors.

While it may seem tedious and unimportant to update your cap table every time there is even the slightest change made, hopefully you can see there is a lot at stake when it comes to keeping track of the equity and managing your company’s cap table. Thank goodness there are software tools to help you stay on top of this and be prepared for when your investors say, “Can I see your cap table?”

About Startup Stack

Our mission is to support startups in establishing the foundational toolkit for operational excellence, at exclusive discounts. There are a lot of tools out there to consider when building a business. The Startup Stack was created to help make choosing a stack easier for founders, by sourcing the best operational tech offers available in one place. We are not a review site; we scour the SaaS ecosystem to uncover the best tools that will help startups scale and succeed. Each member of The Startup Stack is carefully vetted for both the quality of their product and the startup offering they provide.

Gust Launch keeps your docs straight and cap table clean for whenever your first raise is.

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.