How to Choose an Incorporation Type

This article originally appeared in Forbes.

Every business, from a mom-and-pop flower shop to the next billion-dollar tech giant, first has to legally establish itself as a company. But, just as there are many kinds of businesses, there are also many ways of establishing a company—and as you can imagine, a flower shop and a would-be Uber are probably not going to be best-served by the same one.

As a serial entrepreneur and active angel investor myself, I’ve founded or funded over 100 companies and understand first-hand the many obstacles you’ll face as a high-growth startup founder. Time and again, I’ve seen founders make mistakes early on—such as choosing the wrong legal classification—that cost them dearly down the road.

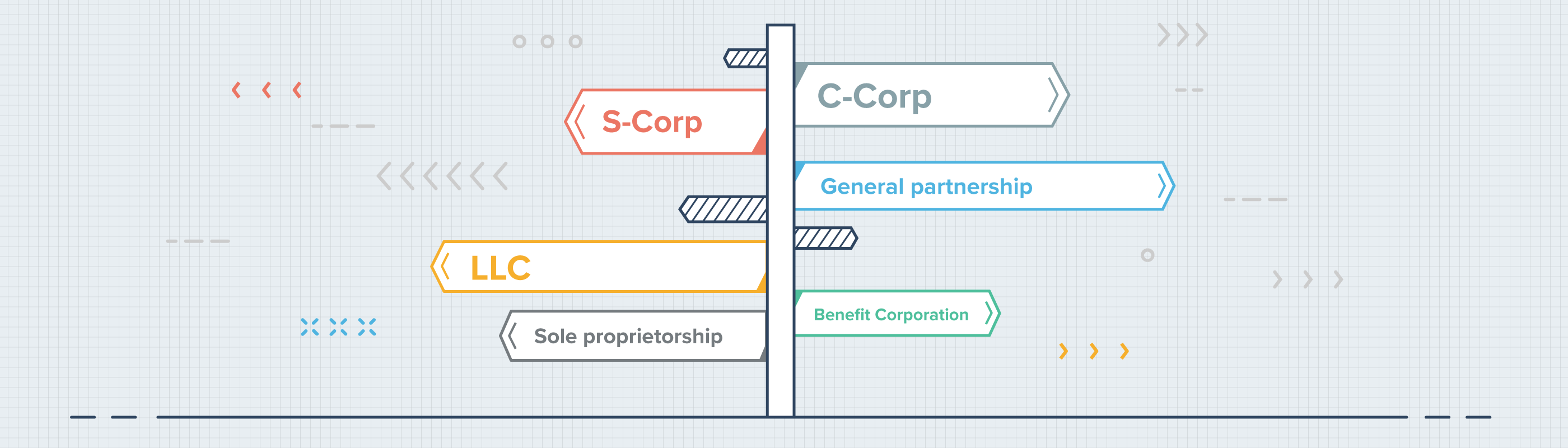

There are many company types you can choose from, and each has its own purpose and advantages. Not every entity type is available in every state, but the choice between each category largely comes down to just a few key questions.

Do you need to protect yourself?

If your company will be entering into contracts, such as hiring employees, making purchases, or taking orders for which you may not immediately be able to deliver the product, you’ll probably want to create an entity that can sign these contracts. This concept, limited liability, means that you will not be personally liable for debts and claims.

Will you be working alone?

In some cases, if you are working on your project without co-founders and don’t need limited liability, you may not need to create an entity at all. A sole proprietorship or “doing business as” (DBA) filing might be sufficient for your needs.

Are you worried about taxing your short-term profits?

Several kinds of company structure are perfect for an entrepreneur who expects to turn profits in the short term and does not want to be liable for paying corporate tax on top of personal income tax. These options, notably the LLC and S-Corporation, make use of a concept called “pass-through taxation” to pass income and losses directly to the entrepreneur, rather than taxing these profits at the company level.

Do you expect (or hope for) substantial growth in the long term?

There are certain tax benefits which are only available to companies that are structured for long-term growth—specifically, the Qualified Small Business Stock rule, which allows holders of C-Corporation stock to exempt huge portions of their value increase from taxation after a certain period.

Will you be seeking outside investment?

This is a big question. Many entrepreneurs founding high-growth startups miss out on the potential benefits of a C-Corporation because of common wisdom that pushes pass-through taxation as a major decision-making factor. Unfortunately for these founders, professional investors almost never enter into investment deals with entity types other than C-Corps, meaning that these companies will need to go through a potentially very costly restructuring at their first round. Because lawyers often bill at high hourly rates, this can rapidly erase any savings achieved in the initial phase of the startup.

Does your company have social motives other than profit?

In certain states, entrepreneurs can take advantage of a new set of rules that create entities called Benefit Corporations. While these structures vary from state to state, what they have in common is that they include the company’s social mission in the bylaws, as a protected (and mandated) aim of the company. For this option, founders need to know that they will be subject to additional requirements.

To help with your decision, we’ve created a flowchart for entrepreneurs of all kinds to find the corporate form most likely to fit their needs. It is easy to see that company structures vary significantly in complexity, and in the protections and benefits a given structure provides.

Important note:

This should not be taken as legal advice, and if you are a founder you should be sure to consult a lawyer before making an incorporation decision. But it certainly helps to know your options. To familiarize yourself with the ins and outs of incorporation and company formation—particularly in the context of high growth startups—check out Gust’s Guide to Startup Incorporation. Taking time to explore your options up front will save you time and money, two of the most critical resources for every founder. Starting on the right foot—or as the right business entity—is the best way to set your venture up for success.

Learn how to pick the right startup legal entity:

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.