True Story: Why We Turned This Deal Down

This is about a deal my angel group turned down.

The software looks excellent. I wanted to use it immediately. There’s urgent and widespread market need. It’s obviously proprietary too. It’s a crowded noisy market, but it feels like this one has a real shot at it. Furthermore, the entrepreneur behind it is proven. The software grew out of the needs of a successful professional service business. There’s relatively low risk of failure.

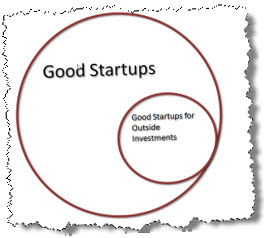

So why did we turn it down? Because this one doesn’t need our investment. It’s quite possibly better off growing on its own bouyed by the resources of that professional service company. The entrepreneur could get it past cash flow break-even and continue growing so it would never look back.

We don’t want to end up with a minority share of a company that has no incentive to exit. No

Gust Launch can set your startup right so its investment ready.

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.