Gust for individual investors is coming soon

In the meantime, enter your email address to receive exclusive industry news, trends and updates from Gust.

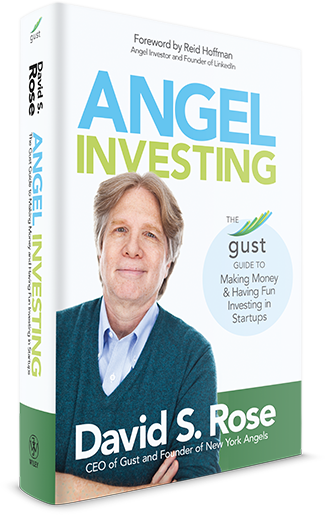

Angel Investing by David S. Rose

The Gust Guide to Making Money & Having Fun Investing in Startups

The bottom line, for your own sanity, is that you need to avoid wasting a lot of time scrutinizing startups that are not ready for prime time.

How much are business plan numbers and revenue projections in prelaunch business plans usually off compared to actual post-launch figures? Oh...roughly the equivalent of the difference between the Gutenberg Bible and The Cat in the Hat.

The smartest, most successful angels try to invest into between 20 and 80 companies, thereby limiting the number that will be lost on any one in particular.

Most people who call themselves “angel investors” don’t carefully select or manage their investments, don’t take a long term view, and don’t have a clue about how to approach angel investing seriously.

You should decide up front how much money you are comfortable with investing each year into angel opportunities, and then mentally commit to maintaining that level for five to ten years.

Integrity. The sine qua non. This is what I listen for first when I meet any company founder, and if I don’t get an internal reading that the entrepreneur is completely forthright and square, I don’t go any further, no matter how much potential I see in the company.

– David S. Rose